The title concerns a study by the OECD and EUIPO. This study presents analysis of the value, scope and magnitude of world trade in counterfeit and pirated products. This report, based on data for 2016, estimates that in that year, the volume of international trade in counterfeit and pirated products could amount to as much as USD 509 billion. This represents up to 3.3% of world trade. This amount does not include domestically produced and consumed counterfeit and pirated products, or pirated digital products being distributed via the Internet. In the previous study from 2013, the share of world trade was 2.5%, or USD 461 billion.

Between 2013 and 2016, the share of trade in counterfeit and pirated goods in global trade grew very significantly. Moreover, this growth was reported during a period of a relative slowdown in overall world trade. Consequently, the intensity of counterfeiting and piracy is on the rise, with significant potential risk for intellectual property (IP) in the knowledge-based, open and globalised economy.

The study also performs an assessment of the situation in the European Union. The results show that in 2016, imports of counterfeit and pirated products into the EU amounted to as much as EUR 121 billion (USD 134 billion), which represents up to 6.8% of EU imports, against 5% of EU imports in 2013.

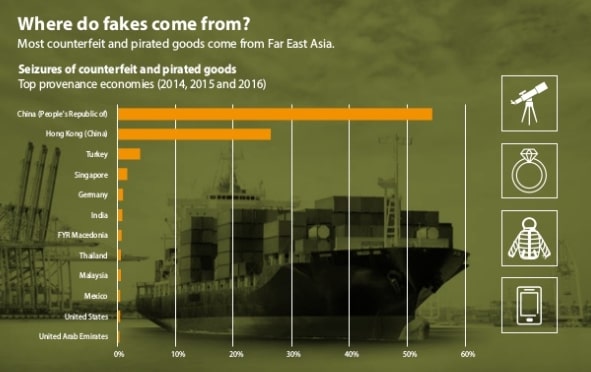

Counterfeit and pirated products continue to follow complex trading routes, misusing a set of intermediary transit points. Many of these transit economies host large free trade zones that are important hubs of international trade.

The use of small shipments for trade in fakes also keeps growing. Small shipments, sent mostly by post or express services, are an example of greater trade facilitation; on the other hand, they are also a way for criminals to reduce the chance of detection and minimise the risk of sanctions. The proliferation of small shipments raises the cost of checks and detention for customs and introduces additional significant challenges for enforcement authorities. There is thus a need for coordinated examination of policies in this area.

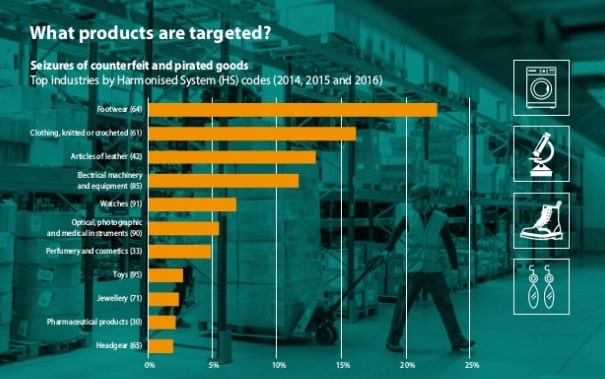

Fake products can be found in a large and growing number of industries, such as common consumer goods, (footwear, cosmetics, toys), business-to-business products (spare parts or chemicals), IT goods (phones, batteries) and luxury items (fashion apparel, deluxe watches). Importantly, many fake goods, particularly pharmaceuticals, food and drink, and medical equipment, can pose serious negative health and safety risks.

While counterfeit and pirated goods originate from virtually all economies in all continents, China and Hong Kong (China) continue to be by far the biggest origin.

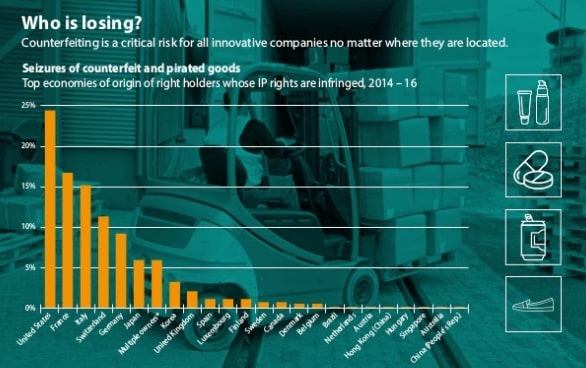

The companies suffering from counterfeiting and piracy continue to be primarily registered in OECD countries; mainly in the United States, France, Italy, Switzerland, Germany, Japan, Korea and the United Kingdom. However, a growing number of companies registered in high-income non-member economies, such as Singapore and Hong Kong (China), are becoming targets. In addition, a rising number of rights holders threatened by counterfeiting are registered in Brazil, China and other emerging economies. Counterfeiting and piracy thus present a risk for all innovative companies that rely on IP to support their business strategies, no matter where they are located.

To understand and combat this risk, governments need up-to-date information on the magnitude, scope and trends of counterfeit and pirated trade. This study aims to shed some light on illicit trade, but further analysis is needed to support policy and enforcement solutions, and enable governments and agencies worldwide to work together.